Gold has always had a special place in Indian hearts — and portfolios. Whether it’s for financial security, festive gifting, or just tradition, gold continues to be a timeless asset. But with evolving times, how we buy and store gold has also changed.

Enter Digital Gold – a modern, secure, and convenient way to invest in the yellow metal. Now available on InCred Money, it brings the trust of gold with the ease of online investing.

🟡 Why Should One Invest in Gold?

Gold isn’t just a shiny ornament—it’s also a strategic asset in your portfolio. Here’s why:

- Hedge against inflation: Gold often holds its value even when inflation erodes the value of paper currencies.

- Safe haven: During market downturns or global uncertainties, gold remains relatively stable.

- Diversification: Gold’s performance typically has a low correlation with equities, helping reduce overall portfolio risk.

- Liquidity: Gold is one of the most liquid assets globally.

- Cultural relevance: In India, gold is an emotional and symbolic investment, often passed through generations.

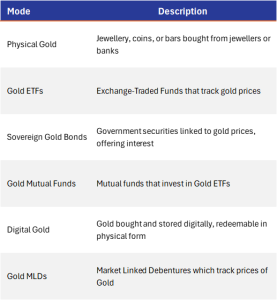

🛤️ What Are the Avenues in India to Invest in Gold?

Today, you can invest in gold through various forms:

💻 What is Digital Gold?

Digital Gold allows you to buy, sell, or accumulate gold online—without needing to take physical delivery. Each unit you buy is backed by 100% physical gold, securely stored in insured vaults by trusted third-party custodians like MMTC-PAMP, Augmont, or SafeGold.

With InCred Money, you can now:

- Buy or Sell gold anytime, anywhere

- Start buying with as low as ₹10

- Set up an SIP

- Track prices live and invest instantly

- Redeem for 24K physical gold whenever you want

🛡️ How is Digital Gold Safe?

Your digital gold investment on InCred Money is built on trust, safety, and transparency:

- 100% Backed by Physical Gold: Every rupee invested is matched with physical gold in insured vaults.

- Stored Safely: The gold you buy online is physically allocated in your name and securely stored in fully insured, certified vaults at MMTC-PAMP’s high-security facility.

- Independent Trustee Oversight: Additional security is provided by Universal Trusteeship Services Ltd. (UTSL), who acts as a custodian of the gold on behalf of the customer.

- Secure Transactions: Bank-grade encryption ensures safe and seamless transactions.

- Instant Liquidity: Sell your gold instantly and get cash credited directly to your linked account.

📊 What is MMTC-PAMP

MMTC-PAMP is India’s most trusted and internationally accredited gold refinery and bullion brand. It is a joint venture between MMTC Ltd., a Government of India enterprise, and PAMP SA, a global leader in precious metals refining based in Switzerland.

MMTC-PAMP is known for producing 99.99% pure 24K gold, adhering to the highest global standards of quality, transparency, and ethical sourcing. It is also the only refinery in India to be LBMA-accredited, ensuring that every gram of gold is backed by international credibility and trust.

📊 Where is my Gold actually stored?

Digital Gold is fully backed by physical 24K gold, stored securely in insured vaults by trusted custodians.

Here’s how it works:

- For every unit of digital gold you buy, an equivalent amount of real, 24K gold (999.9 purity) is purchased on your behalf by the platform partner i.e. MMTC-PAMP for InCred Money.

- This gold is then stored in fully insured and audited vaults operated by these custodians.

So, while you hold your gold digitally, rest assured — it physically exists, safely stored, and is 100% allocated to you.

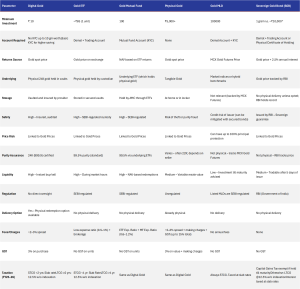

📊 Digital Gold Comparison with other options

💰 Taxation of Digital Gold

Taxation for Digital Gold is treated like physical gold:

- Short-Term Capital Gains (STCG): If sold within 2 years, gains are added to your income and taxed as per your slab.

- Long-Term Capital Gains (LTCG): If held for more than 2 years, gains are taxed at 12.5% without indexation benefits.

💡 Tip: To minimize tax impact, consider holding digital gold for more than 2 years.

💎 Why Choose Digital Gold on InCred Money?

- Seamless Experience: Buy/sell at your fingertips through a trusted platform

- Low Ticket Size: Start with just ₹10

- Trusted Partner: MMTC-PAMP

- Instant Liquidity: No lock-ins, withdraw anytime

- Gifting Option: Send gold digitally to loved ones

🚀 Final Word

Gold may be timeless, but your way of investing doesn’t have to be old-fashioned. With Digital Gold on InCred Money, you get the best of both worlds—the trust of gold and the ease of digital investing.

Whether you’re planning a long-term wealth strategy or just want to gift a loved one something meaningful, digital gold makes it simpler, safer, and smarter.

Ready to go for gold? Start your digital gold journey today on InCred Money.