India’s semiconductor story has, in many ways, been a story of a lost decade — perhaps even two.

In the 1970s and 80s, India had credible hardware capability. We built mini-computers, and ran strong public-sector labs. But over time, we pivoted sharply to software and IT services, while others doubled down on chip manufacturing and supply chains.

Through the 2000s and 2010s, several revival attempts were announced, but most never materialised. Each setback dented credibility. By 2020, India was one of the world’s largest semiconductor consumers, producing virtually none at home.

What’s different now?

The introduction of the Indian Semiconductor Mission (ISM): $10 billion in structured funding, direct PMO oversight, and active engagement with global chip majors.

What India Is Trying to Build

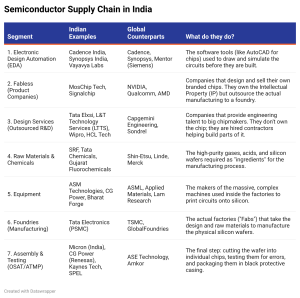

A semiconductor industry is not a single factory. It is an intricate ecosystem where multiple layers must function in harmony. India’s strategy reflects this reality by targeting the entire value chain:

Chip Designers: The architects of circuits

Fabrication Plants (Fabs): Facilities that manufacture chips from silicon wafers

ATMP (Assembly, Testing, Marking, Packaging) & OSAT (Outsourced Semiconductor Assembly and Test): Packaging and testing operations

Suppliers: Providers of specialized materials, gases, and precision equipment

The approach is pragmatic: begin with commercially viable, established technologies and gradually move toward cutting-edge nodes.

I have covered the entire value chain in detail later in the newsletter.

Indian Semiconductor Mission

ISM 1.0: Breaking the Inertia

Launched in December 2021 with an outlay of ₹76,000 crore, ISM 1.0 aimed to break India’s long-standing “zero-fab” barrier by offering fiscal incentives to attract global manufacturers.

While early progress was slower than expected, largely due to execution challenges and logistics around specialized equipment, momentum improved once credible players with strong balance sheets entered.

As of early 2026, 10 major projects with investments exceeding ₹1.6 lakh crore are underway. Key milestones include:

- Micron Technology: ATMP facility in Sanand, Gujarat

- Tata Electronics + PSMC: Fab in Dholera, Gujarat, targeting 28nm chips

- Tata Semiconductor Assembly and Test (TSAT): Assembly unit in Morigaon, Assam

- CG Power + Renesas: OSAT facility in Sanand

Four of these plants — Micron, Tata (Assam), CG Power, and Kaynes are slated to begin commercial production in 2026, marking a historic shift from policy to reality.

ISM 1.0 demonstrated an important lesson: capital is necessary, but not sufficient. Building semiconductor capability demands mastery of complex logistics — clean rooms, ultra-pure materials, and sensitive supply chains.

More importantly, these investments signaled that India is now willing to share the risks of this expensive and cyclical industry.

ISM 2.0: From Assets to Ecosystem

If ISM 1.0 focused on physical infrastructure, ISM 2.0 emphasizes resilience and depth.

Policymakers recognized that factories remain vulnerable when every chemical, component, and design tool is imported. The next phase therefore shifts attention toward strengthening domestic linkages.

What changes under ISM 2.0?

- Supply Chain Localization: Encouraging domestic production of specialized materials and equipment

- Design-Led Growth: Supporting fabless companies and Indian IP creation

- R&D and Skilling: Expanding focus beyond capital expenditure

This evolution reflects a maturing strategy: not just building facilities, but building capability.

The Semiconductor Value Chain

Note: The names are illustrative and not exhaustive.

Think in Decades, Not Quarters

Two structural shifts are working in India’s favour.

First, geopolitics. Global supply chains are being diversified, and companies are actively seeking alternatives to single-country concentration.

Second, cost arbitrage in engineering talent. India has one of the world’s largest pools of chip designers. That makes design, and parts of manufacturing support, more competitive here than in many developed markets.

Politics, talent, and incentives, that combination creates a genuine opportunity window.

This is not a short-term trade. Semiconductor capability is built layer by layer over 15–20 years.

Success will not be measured by one announcement or one subsidy package, but by accumulated capability over time.

If you enjoyed this newsletter, feel free to share it with your friends and family using the link below.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money