Happy Diwali!

We’re sure most of you are busy prepping for Diwali; cleaning up, decorating, buying gifts (and maybe a bit of gold too?). Here’s wishing you and your family a very Happy Diwali filled with prosperity and joy!

Now, while gold and silver have been shining bright this past year, there’s a much bigger world of commodities out there that doesn’t always get the spotlight.

So today, let’s explore the not-so-discovered but also a very important side of the commodity market.

Why Track Commodities?

Because commodities are what keep the world running.

From the fuel in your car to the metal in your phone, everything begins somewhere in the commodity chain. When oil prices jump, logistics costs follow. When copper prices rise, it’s usually a sign that factories are buzzing and economies are picking up steam. And when wheat or sugar prices spike, it hits our grocery bills.

Tracking commodities is like tracking the pulse of the real economy, you start to see how global growth, inflation, and trade all connect.

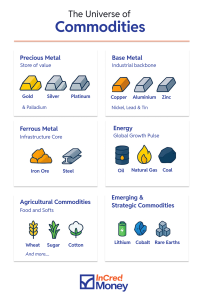

🧭 The Commodity Universe

Here’s how the broad commodity landscape looks when you break it down:

Let’s dig a little deeper into each one.

Precious Metals: The Safe Haven

These are the shiny assets everyone runs to when the world gets shaky.

- Main Drivers: Inflation, interest rates, central bank buying, and the US dollar.

- Major Participants: Central banks, jewellers, investors, and ETF issuers.

- Dominant Themes: Central banks continue to buy gold in record amounts, silver demand is rising due to solar energy adoption, and platinum is gaining importance in hydrogen fuel technology.

Check out our previous newsletters on Gold & Silver.

Base Metals: The Industrial Backbone

If there’s construction or manufacturing happening, base metals are in play.

- Main Drivers: Global growth, infrastructure spending, and mine supply.

- Major Participants: Mining companies, manufacturers, and governments.

- Dominant Themes: The green transition is fuelling long-term demand for copper and nickel, while aluminium producers are navigating the push toward low-carbon production.

Ferrous Metals: The Infrastructure Core

Iron and steel are the backbone of every bridge, building, and railway.

Main Drivers: Infrastructure development, construction demand, and industrial production.

Major Participants: Steelmakers, construction companies, and governments (especially those with large public works projects).

Dominant Themes: Global infrastructure spending is driving steel demand. China’s construction slowdown is affecting iron ore exports, while new technologies like green steel are reshaping the industry’s future.

Energy: The Global Growth Pulse

Energy commodities are what literally power economies. Lower energy prices are always good news for India, we import most of our crude oil and natural gas, so cheaper energy directly helps our economy.

Main Drivers: OPEC decisions, geopolitics, weather, and the shift to renewables.

Major Participants: Oil producers, refiners, energy traders, and governments.

Dominant Themes: High geopolitical uncertainty continues to drive oil price swings, while the gradual move toward cleaner energy is reshaping the long-term demand outlook for fossil fuels.

Agricultural Commodities: The Food & Softs

From your morning coffee to the cotton in your shirt, this bucket covers it all.

Main Drivers: Weather patterns, global trade policies, and fertiliser costs.

Major Participants: Farmers, food processors, and governments.

Dominant Themes: Climate volatility and El Niño are affecting crop yields; sugar and coffee prices have been elevated; and cotton demand is stabilising with the global recovery in apparel manufacturing.

Emerging & Strategic Commodities: The Future-Facing Frontier

These are the metals everyone wants a piece of in the green energy race.

Main Drivers: Electric vehicle adoption, energy transition, and tech manufacturing.

Major Participants: EV makers, battery producers, and governments securing supply chains.

Dominant Themes: Lithium and cobalt are key to the EV boom, rare earths are crucial for electronics and defence, and many nations are trying to diversify supply away from China.

How Do People Invest in Commodities?

These are the metals everyone wants a piece of in the green energy race.

Physical Products: The most direct (and traditional) route. Think of buying gold coins or silver bars, something you can actually hold. But when it comes to most other commodities, storing or transporting them isn’t practical.

Direct Futures: For the pros who trade on exchanges like MCX, NCDEX, LME, or CME.

Commodity ETFs / Funds: A simpler way to get exposure to a mix of commodities. These funds often track indices or baskets of commodities. Some examples: Gold & Silver ETFs (India) – Track prices of Gold and Silver, Invesco DB Commodity Index Fund (US) – Tracks a broad basket of energy, metals, and agriculture.

Shares of Producers: Indirect exposure through mining, refining, or energy companies. Some examples:

Domestic: Hindustan Zinc – for silver, zinc, and lead, Tata Steel – for steel and iron ore, Coal India – for coal and energy exposure.

International: Rio Tinto – diversified miner, Freeport-McMoRan – copper producer, Barrick Gold – global gold miner

Thematic Products: Like Gold Market Linked Debentures (MLDs) or EV Metal Portfolios that track specific commodity themes.

👉 One thing to remember: Commodities move in cycles and can be very volatile. Risk management and timing matter — a lot.

Where Can You Track Prices?

I prefer Trading View and Investing.com to track commodity prices as they consolidate prices from all different markets in one place and also provide historical data.

The Takeaway

Commodities might not always grab headlines like stocks or crypto, but they shape the world around us, from the food on our plates to the power in our homes. Understanding them gives you a front-row seat to how the global economy really moves.

If you enjoyed this newsletter, feel free to share it with your friends and family.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money