Everyone’s asking: Is artificial intelligence the bubble of our generation? Tech stocks are on fire, billions are chasing startups, and expectations feel sky-high.

But before we dive into whether AI is the real deal or heading for a spectacular crash, let’s take a trip through history’s hall of financial fame – or should we say, infamy.

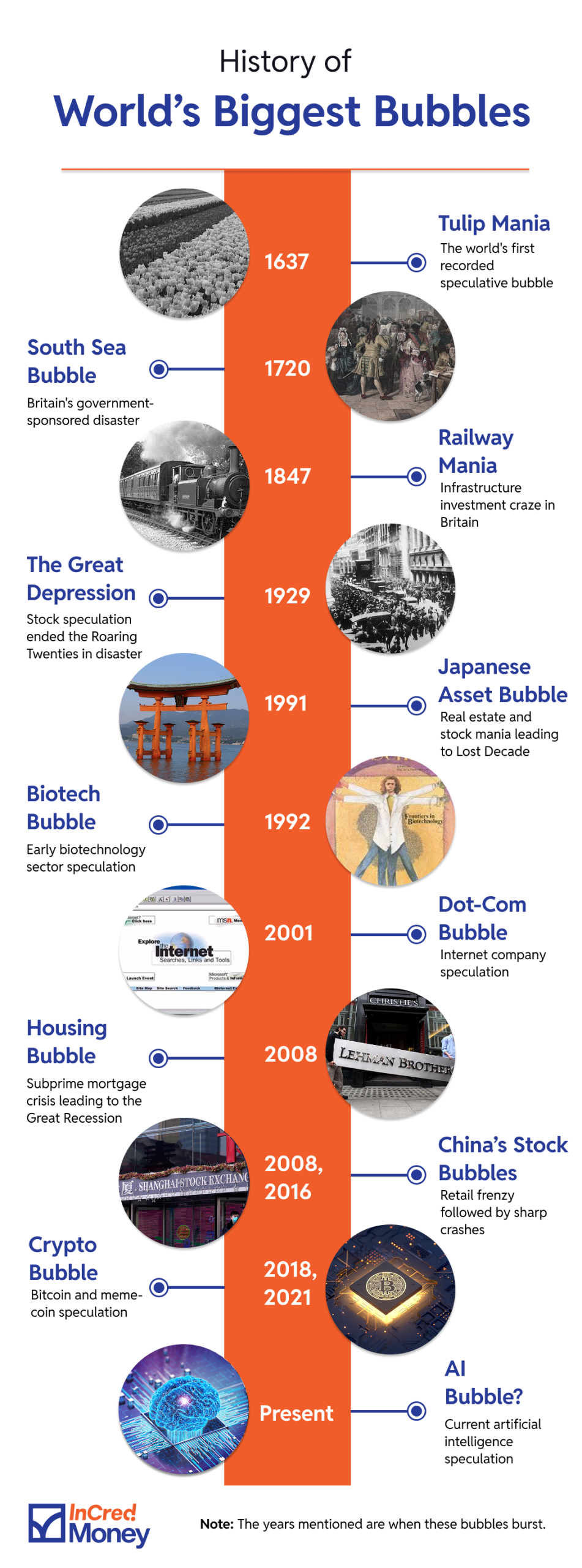

Bubbles aren’t new. They’re as old as markets themselves, following eerily similar patterns across centuries. People get excited about something revolutionary, prices go through the roof, everyone jumps in thinking they’ll get rich quick, and then… pop! The question isn’t whether bubbles will happen – it’s whether you’ll see them coming.

Tulip Mania (1630s): Flowers Worth More Than Mansions

Picture Amsterdam in the 1630s. Tulips – exotic flowers just introduced from the Ottoman Empire – had taken Europe by storm. Rare bulbs with vivid streaks (caused by a virus, no less) were status symbols for the wealthy. Prices soared until a single bulb of “Semper Augustus” could buy a luxurious canal-side mansion.

Speculation soon went wild. Tulip contracts were traded before bulbs even bloomed, creating an early futures market. Everyone from merchants to craftsmen piled in. But in February 1637, at an ordinary auction, buyers simply didn’t show. Panic spread, prices fell 90% in weeks, and fortunes evaporated.

The Dutch economy survived, but individual investors were ruined. The lesson? Even something beautiful and novel can become dangerously overpriced once speculation takes hold.

Railway Mania (1840s): Britain’s Speculation Express

Fast forward two centuries, and Britain caught “railway fever.” Early lines like Liverpool-Manchester proved hugely profitable, sparking dreams of connecting the nation. Parliament was inundated with proposals, and cheap financing made it easy for ordinary investors to buy in with as little as a 10% deposit.

In 1845 alone, 3,000 miles of new track were approved – as much as the previous 15 years combined. Investment in railways rose to 7% of GDP, swallowing half of the country’s capital formation. The mania gripped everyone, from middle-class families to celebrities like Charles Darwin and the Brontë sisters.

But the boom was built on wildly optimistic revenue forecasts. By the late 1840s, reality hit, share prices collapsed, and Britain entered a painful recession. Investors lost fortunes, though unlike tulips, the tracks remained. The bubble destroyed wealth but left infrastructure that reshaped society for centuries.

The Dot-Com Bubble (1999-2000): When .Com Meant .Ca$h

The late 1990s were electric. The internet promised to change everything, and investors believed any company with a “.com” in its name was destined to be huge. The Nasdaq surged 86% in 1999 alone, peaking above 5,000. Business models didn’t matter – “eyeballs” and “mindshare” were the buzzwords of the day.

Venture capitalists threw billions at startups with no revenue and no profits. Companies went public overnight and saw valuations skyrocket. Pets.com, with its sock-puppet mascot, became iconic – and collapsed within a year.

By 2000, investors began asking the obvious: when would these firms actually make money? The bubble burst, and the Nasdaq lost nearly 80% of its value, erasing over $5 trillion. Thousands of dot-coms died, but survivors like Amazon, eBay, and Google thrived, proving the internet was revolutionary – just not at 1999 prices.

The Housing Bubble (2008): The Crash That Shook the World

If the dot-com bust was painful, the housing crash was catastrophic. In the early 2000s, deregulation and cheap credit created a housing frenzy in the US. Subprime lenders extended mortgages to people with poor credit, while exotic loans like adjustable-rate mortgages made home-buying accessible to almost anyone.

Homeownership surged, and flipping houses became a national obsession. Wall Street packaged risky mortgages into complex securities, spreading the risk worldwide. For a while, it seemed like everyone was making money.

But when interest rates rose, millions of borrowers couldn’t keep up. Foreclosures exploded, home values collapsed, and mortgage-backed securities turned toxic. Lehman Brothers went under, global markets froze, and the Great Recession began. Trillions in household wealth evaporated, unemployment soared, and the financial system barely survived.

(Dis) Honourable Mentions

- South Sea Bubble (1720): Britain’s overseas trade hype turned sour

- The Great Depression (1929): Stock speculation ended the Roaring Twenties in disaster

- Japan’s Asset Bubble (1980s): Tokyo real estate and stocks hit absurd highs before imploding

- Crypto & Meme Stocks (2020-21): Social-media-fueled rallies fizzled as fast as they rose

- China’s Stock Bubbles (2005-08, 2014-16): Retail frenzy followed by sharp crashes.

The Universal Bubble Pattern

History shows bubbles follow the same playbook:

- A revolutionary idea emerges (tulips, railways, internet, housing, AI?)

- Early adopters profit handsomely (creating success stories)

- Media hype + FOMO grip the crowd

- Cheap money fuels speculation

- Reality sets in (revenues can’t match expectations)

- Panic selling and collapse

AI Today: Revolution or Rerun?

Now back to our time. AI has all the signs of a rage – we’re clearly in stages 3–4. Nvidia’s stock is up more than 800% since 2023. Corporations are spending $300B+ annually on AI, yet a recent MIT survey found 95% of them see no return on investment. Some companies are rebranding with “AI” in their names, echoing the “.com” craze of the ’90s.

Still, there are key differences. Unlike many dot-coms, today’s AI giants – Microsoft, Google, Amazon – already generate massive profits. AI isn’t a distant dream; it’s in products millions of people use daily, from ChatGPT to medical diagnostics.

The worry? Nvidia’s “circular money loop” – investing billions in AI startups that then buy Nvidia chips. It’s eerily reminiscent of companies propping up their own demand during past bubbles.

Whether we hit stage 5 depends on whether today’s investments deliver results that justify sky-high valuations.

Final Word

AI is transformative – no one doubts that. But history warns us: technology revolutions and investment bubbles often go hand in hand. The internet changed the world but bankrupted thousands of dot-com investors. Railways reshaped Britain but wiped out shareholders. The danger isn’t in the technology itself. It’s overpaying for it. Because when the music stops, even the most dazzling flowers… are still just flowers.

TL;DR: A Historical Timeline of Bubbles

If you enjoyed this newsletter, feel free to share it with your friends and family.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money