It’s the oldest saying in politics: “The enemy of my enemy is my friend.”

At the recent Shanghai Cooperation Organization (SCO) summit, Modi, Xi, and Putin (leaders with different ideologies) were suddenly on the same stage, speaking the language of partnership.

What’s driving this unlikely camaraderie?

Donald Trump, his tariff tantrums, and his unpredictable foreign policy.

Across the world, nations are gravitating toward BRICS not out of ideology but necessity. When the world’s biggest player keeps changing the rules, everyone else starts building their own team. BRICS is becoming that team.

And Trump is worried.

First, Who is Actually in BRICS?

BRICS began in 2006 with Brazil, Russia, India, and China. South Africa joined later. For years, it felt like a talking shop with big ambitions but little action.

That’s no longer the case.

In August 2023, BRICS invited six new countries: Egypt, Ethiopia, Iran, Indonesia, Saudi Arabia, and the UAE. The bloc’s weight is undeniable:

- 49.5% of the world’s population

- 40.0% of global GDP (PPP terms)

- 26.0% of global tradeSource: www.mea.gov.in

Suddenly, BRICS isn’t just an acronym. It’s becoming an economic counterweight.

Why is Everyone Suddenly Talking About BRICS?

1. America’s Financial “Superpower” is Being Challenged

For decades, the world ran on the petrodollar system — oil was priced in dollars, forcing countries to hold USD reserves. This gave America extraordinary financial leverage.

But when the US froze Russia’s dollar reserves in 2022, it shocked the world. It felt like putting your life savings in a bank, only for the banker to say, “We don’t like your politics, so you can’t withdraw.”

Suddenly, holding dollars felt risky. Central Banks of countries like ours, China, Poland, among others, responded by buying gold at record rates and exploring alternatives.

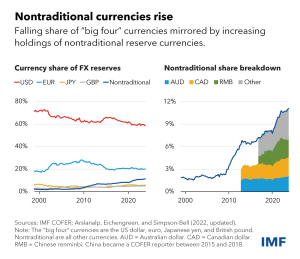

The trend is clear:

- Dollar’s share of global reserves: ~70% in 2000 → under 60% today

- “Nontraditional” currencies like the yuan, Canadian dollar, and Australian dollar: up 3x to 12% in the same period.

2. SWIFT: America’s Silent Economic Weapon

Most people have never heard of SWIFT, but it’s the backbone of global finance.

Think of SWIFT as the world’s banking WhatsApp. It doesn’t move money but sends secure payment instructions between banks worldwide. Without it, cross-border trade grinds to a halt.

Here’s the catch: SWIFT is deeply tied to the US financial system. Cut a country off from SWIFT, and you’ve effectively cut it off from global trade, “choking an economy without firing a shot.”

Now BRICS is fighting back:

- BRICS Pay and digital currencies like China’s digital yuan aim to bypass SWIFT

- Local-currency trade settlements (e.g., rupee–dirham, yuan–rouble) are growing

- Gold reserves on central bank balance sheets are rising

This isn’t about killing the dollar overnight. It’s about building insurance against US financial pressure.

3. Trump’s Tariff Shockwaves

Trump’s 50% tariff on Indian exports, threats over Russian oil, and talk of 10–100% duties on “BRICS-friendly” nations have spooked global partners.

Ironically, tariffs are backfiring at home, US households are paying $2,700 more annually thanks to higher prices. Many countries now view US trade policy as weaponized unpredictability, pushing them to seek alternatives.

Why is Trump Afraid of BRICS?

Because BRICS threatens America’s greatest privilege: dollar dominance.

The US can run massive deficits because the world needs dollars for oil and trade. But if BRICS convinces even one major oil producer, say Saudi Arabia, to accept Yuan or Rupees, the dollar’s monopoly cracks.

Without that privilege, America’s ability to fund its economy and project power weakens.

Trump knows this. His angry posts on X (Twitter) may seem impulsive, but the fear is real: BRICS is building financial escape routes the US can’t control.

India in the Spotlight

Historically, India has often been viewed as a key strategic partner for the United States, particularly in balancing China’s growing influence in Asia and beyond.

This perception was rooted in shared democratic values, economic ties, and a common interest in maintaining a free and open Indo-Pacific. However, a fascinating twist in this narrative is India’s increasingly central role within the BRICS bloc.

Trump’s 50% tariffs on India and his dismissive remarks about India, remember the “dead economy” jibe, haven’t helped. Meanwhile, Xi has backed India’s 2026 BRICS presidency, and both leaders have started framing ties as “partnership, not rivalry.”

India’s appeal is obvious: a huge consumer market, deep tech talent, and a tradition of non-alignment. That makes New Delhi the ultimate swing player in today’s geopolitics: courted by Washington for its markets, by Beijing for its supply-chain heft, and by Moscow for its energy links.

So, is Trump afraid of BRICS?

Yes.

Not because BRICS is perfectly united, it isn’t. But because for the first time in decades, the world is openly building alternatives to the dollar system.

Trump’s “America First” approach may have triggered exactly what he feared most: a world that doesn’t need to tiptoe around Washington.

The dollar is still king, but rivals are entering the ring. And ironically, the man who gave them the momentum might be Donald Trump himself.

If you enjoyed this newsletter, feel free to share it with your friends and family.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money