Last November, we wrote about how Silver was finally stepping out of Gold’s shadow (you can read it here). In the last six months, silver has rallied ~19%, while gold has given a solid 14.2% gain (Source: goldprice.org). Clearly, investors aren’t giving up on the yellow metal anytime soon.

For Indians, Gold isn’t just an investment—it’s woven into weddings, festivals, gifts, and even inheritances. Traditionally, we never paused to ask, “Is it the right price?” We simply bought it. But now that Gold has crossed the ₹1,00,000/10g mark, hesitation is creeping in.

So, is Gold still worth it? Let’s have a look.

Gold is a Proven Performer

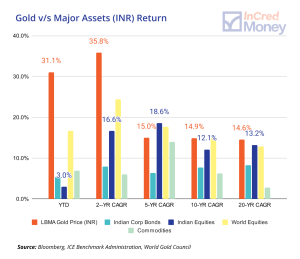

No matter the timeframe — 2, 10, or even 20 years—Gold has consistently outpaced equities, bonds, and commodities in India. Globally too, in 2025 so far, Gold has outperformed developed and emerging market equities and even traditional safe havens.

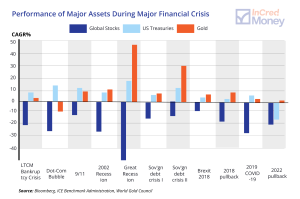

Gold Thrives in Uncertainty

From trade wars to shifting geopolitics, policy uncertainty has made investors wary of US-dollar assets. Gold shines in such moments, it protects value when currencies weaken and cushions portfolios when markets wobble.

History proves this: in the most of the global recessions since 1998, Gold beat equities. Remember 2008? While stock markets crashed, Gold stood tall. That reliability under stress makes it the ultimate hedge.

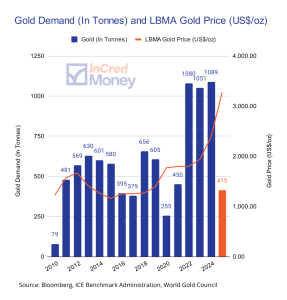

Central Banks Are Buying Big

It isn’t just retail investors. Central banks have bought 1,000+ tonnes annually for three years in a row — double the pace of the last decade. Nearly 95% of central banks expect global reserves to rise further. If trillion-dollar balance sheets are leaning on Gold, it’s a signal no investor should ignore.

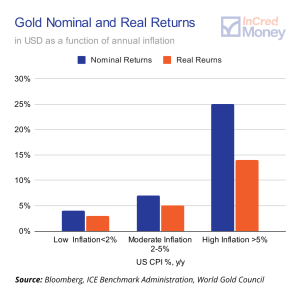

Gold Shields Against Inflation

Gold isn’t only a crisis asset. Over decades, it has shown low volatility, making it a natural stabilizer in portfolios. And with falling real interest rates, holding Gold becomes even more attractive. When yield-bearing assets lose shine, Gold steps up as a durable inflation and currency hedge.

So what now?

At ₹1,00,000, Gold feels expensive. But its fundamentals are stronger than ever: policy uncertainty, central bank demand, historical crisis resilience, and inflation protection all reinforce its role as a wealth preserver.

Gold may be timeless, but the ways to invest in it have changed. If you want Gold in your portfolio, today’s smarter options make it easier, and often better than ever.

I hope you have found this perspective on Gold interesting. Do let me know your thoughts on Gold and what do you think is the best way to purchase it.

If you enjoyed this newsletter, feel free to share it with your friends and family using the link below.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money