The US is undoubtedly the global hub of innovation. Name a major technological advancement, and odds are that an American company is leading the charge. The US is also home to corporate giants with truly global footprints, including Apple, Google, Meta, Microsoft, Nvidia, and more.

These companies are not only revenue powerhouses, but profit machines. As their earnings have grown, it’s no surprise that their stock prices, as well as indices like the S&P 500 and Nasdaq, have soared.

But there’s an interesting twist to the story. Beyond their operational success, many of these companies rely on a clever piece of financial engineering to keep boosting shareholder value—without actually changing their business operations.

This tool? The Share Buyback.

What’s a Share Buyback?

In simple terms, a share buyback is when a company purchases its own shares from the market (or directly from shareholders).

Like dividends, it’s a way to give money back to shareholders.

But here’s the key difference: while dividends put cash directly into your pocket, buybacks can make the value of your shares go up — without the company having to earn a single extra rupee in profit.

And that’s exactly why Corporate America loves them.

Why Buybacks Are Corporate America’s Favourite Weapon

1. Boosting Share Price via EPS

When a company buys back shares, it reduces the number of shares outstanding. Even if profits stay the same, Earnings Per Share (EPS) goes up because the profit is now divided among fewer shares.

Higher EPS often means higher stock prices, because investors and algorithms alike see “growth” and reward the stock.

Example:

- Before Buyback

Profit: ₹100 crore

Shares outstanding: 10 crore

EPS = ₹10 - Buyback

Company buys back 2 crore shares → 8 crore shares remain

Profit still ₹100 crore - After Buyback

EPS = ₹12.50 (Rs 100 Crore / 8 Crore shares) → up 25% without any real profit growth

If the P/E ratio remains the same, the stock price rises proportionally.

2. Better Return Ratios

Buybacks are funded from reserves (like dividends). This reduces the equity base, which can improve metrics like Return on Equity (ROE) and Return on Capital Employed (ROCE) — even without any real operational improvements.

3. Flexibility

Unlike dividends (which create an expectation of regular payouts), buybacks are a one-time decision. Companies can pull the trigger when market conditions are favourable, and pause them during tougher times.

The Scale of US Buybacks

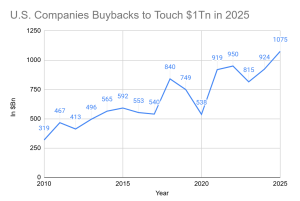

As of early August 2025, US companies had announced buybacks worth $926 billion (~₹77.26 lakh crore). Goldman Sachs expects this to cross $1 trillion (~₹83.5 lakh crore) by the year-end.

That’s nearly a trillion dollars not going into factories, R&D, or hiring, but straight into buying back shares.

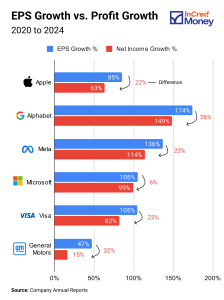

EPS Growth vs. Profit Growth: A Telling Comparison

From 2020 to 2024, the biggest US companies saw EPS grow faster than their net profits — thanks, in part, to buybacks:

Looking at Buybacks with a critical lens

- Signal of Limited Growth Opportunities: If a company has too much spare cash and no better way to invest it, it may opt for buybacks.

- Financial Engineering, Not Real Growth: Ratios improve, but the company itself isn’t producing more goods or services.

- No Broader Economic Impact: Unlike new factories or product development, buybacks don’t create jobs or expand the economy.

Why India Hasn’t Embraced Buybacks Like the US

1. Different Stage of Corporate Maturity

Many large US companies are capital-light and mature, they don’t need to reinvest much in physical assets. In India, to this day, there are only a handful of companies that can be considered mature and capital-light (e.g., IT, FMCG, Consumer Discretionary). A large portion of the big players — such as banks, NBFCs, telecom companies, auto manufacturers, infrastructure firms, and oil & gas companies, operate in capital-heavy sectors with limited free cash to return to shareholders.

2. Tax Rules Have Been a Moving Target

In India, the taxation of dividends and buybacks has constantly shifted:

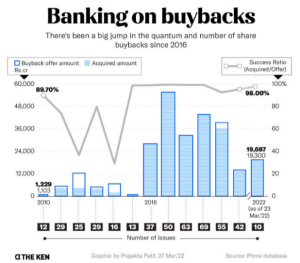

Pre-2016: Dividends tax-free for shareholders, but companies paid Dividend Distribution Tax (DDT). Buybacks taxed as capital gains for shareholders → Dividends more attractive.

2016–2019: High-net-worth shareholders taxed on dividends above ₹10 lakh, making buybacks more appealing → IT companies led the buyback boom.

Companies that undertook buybacks: TCS, Infosys, Wipro, HCL Tech

2019-2024: DDT has been abolished, with dividends now taxed in the hands of investors at their marginal tax rate. While a buyback tax has been introduced, buybacks still remain more tax-efficient than dividends.

Companies that undertook buybacks: TCS, L&T, Bajaj Auto

Post-Oct 2024: Buybacks fully taxed as dividends, no cost deduction allowed → Dividends now more favourable again.

How taxation currently works: When a company buys back the shares, the entire amount you get is treated just like dividend income. It is added to your taxable income and taxed according to your marginal tax rate. You can’t deduct what you originally paid for those shares before paying tax. However, you can claim that original cost as a “capital loss” and use it to reduce taxes you pay on profits from selling other investments in the future. This makes share buybacks pretty expensive in terms of tax for Indian investors.

Effectively, just when Indian companies started to embrace buybacks, the tax advantage disappeared.

The Moral of the Story

In the US, buybacks thrive because of corporate maturity, capital-light models, and tax-friendly rules. In India, they’ve been more of a passing phase—derailed by shifting tax laws and less cash-rich corporate structures.

While buybacks can be a powerful financial tool, they’re not magic—they don’t create value for the economy, just for shareholders. For India, unless tax rules shift again, dividends will likely remain king.

I hope you enjoyed this newsletter and if you did, feel free to share it with your friends and family.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money