You probably haven’t thought much about the tiny magnets inside your phone or the motor in your EV. Honestly, neither had I. But in the last few weeks, those tiny components have triggered some very loud conversations in global boardrooms.

From EV deliveries getting pushed back to over 21,000 jobs at risk in the global audio industry, just about every sector that relies on high-performance magnets is feeling the heat.

Rare Earth Elements (REEs) like lanthanum, cerium, neodymium, praseodymium, europium, and yttrium, powers modern life, from electric cars to defence systems.

And with the world’s reliance on China exposed, India is moving quickly to reduce its dependence and build self-reliance in this critical sector.

Here’s a look at the this issue, why it matters right now, and what is India doing to become Aatmanirbhar in REEs.

Why Are Rare Earth Elements (REEs) in the News?

They are back in the spotlight as global tensions rise and countries scramble to secure critical mineral supplies. In April 2025, China, which controls around 70% of global REE output, tightened export rules on seven key elements and permanent magnets. These new restrictions, including stricter licensing and monitoring, led to shipment delays of up to two months.

The impact was immediate and widespread:

- China’s Rare Earth magnet exports plunged 75%.

- Automakers and electronics firms across Europe, the US, and India have faced production slowdowns and temporary shutdowns.

- In India, Bajaj Auto has warned of zero EV production in August if supplies don’t resume soon.

The episode has exposed a hard truth: REEs are now a major chokepoint in the global supply chain for clean energy, high-tech electronics, and modern defence systems.

What are REEs and Why the Name?

Rare Earth Elements or REEs are a group of 17 metals critical to technologies such as electric vehicles, wind turbines, smartphones, defense systems, and medical equipment.

Despite their name, most REEs are relatively abundant in the earth’s crust, but are rarely found in economically viable concentrations and require complex extraction and refining processes.

Their unique magnetic, optical, and chemical properties make them indispensable for manufacturing high-strength, heat-resistant magnets, advanced alloys, and specialist components. If you’re curious to know more about these 17 elements and what they do, click here!

Who are the Main Producers of REEs

How is China Using REEs for Geopolitical Dominance?

China’s dominance in REEs goes far beyond mining, it also controls most of the world’s refining and magnet-making. Over decades, it has built an unmatched ecosystem led by state-owned giants, giving it serious geopolitical and economic leverage.

Here’s how China is using that power:

- Export restrictions: In April, China added red tape to seven key REEs, delaying global shipments.

- Pricing power: With supply tight, global buyers paid up to 30% more than Chinese rates.

- Manufacturing pressure: Many companies are now being nudged to relocate operations to China for reliable access.

What is India doing about it?

India holds the third-largest Rare Earth reserves globally (~6.9%), mostly in Odisha, Kerala, and Tamil Nadu.

Yet, it contributes less than 1% to global supply and imports nearly all high-value components like magnets from China.

That’s changing fast. Here’s how India is building self-reliance:

- National Critical Minerals Mission (NCMM): Launched in Jan 2025 with a ₹163bn (~$2bn) budget to boost mining, refining, and manufacturing.

- REEs Development Scheme (Proposed): ₹50bn fund to draw private and public investment into mining and processing.

- PLI Scheme: Incentives for making Rare Earth magnets locally, key for EVs and defence.

- Exploration Auctions: REE blocks opened to private and global players for faster exploration.

- Urban Mining: Push to recover REEs from e-waste.

- IREL Expansion: India’s state-run miner is setting up a magnet plant in Vizag and ramping up oxide production.

India’s goal is clear: cut dependence on China and build a full REE value chain, from mine to magnet.

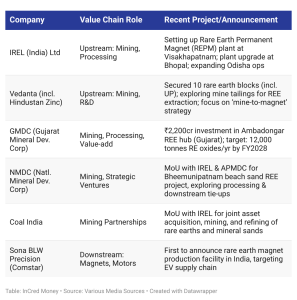

Who’s Doing What in India?

Outlook and Conclusion

The global Rare Earth Elements crunch is real, and India is feeling it too. EVs, electronics, and defence are all at risk of delays due to our over-reliance on China.

But the good news? India is now acting fast and thinking big, with mining projects, magnet plants, and policy moves that could make it a serious regional player in the coming decade.

If India gets this right, REEs could become not just a challenge, but a once-in-a-generation opportunity.

I hope you enjoyed this newsletter and if you did, feel free to share it with your friends and family.

Also, if you have any topics that you would like us to cover or any other feedback, do write to us at connect@incredmoney.com

Till the next time,

Vijay

CEO – InCred Money