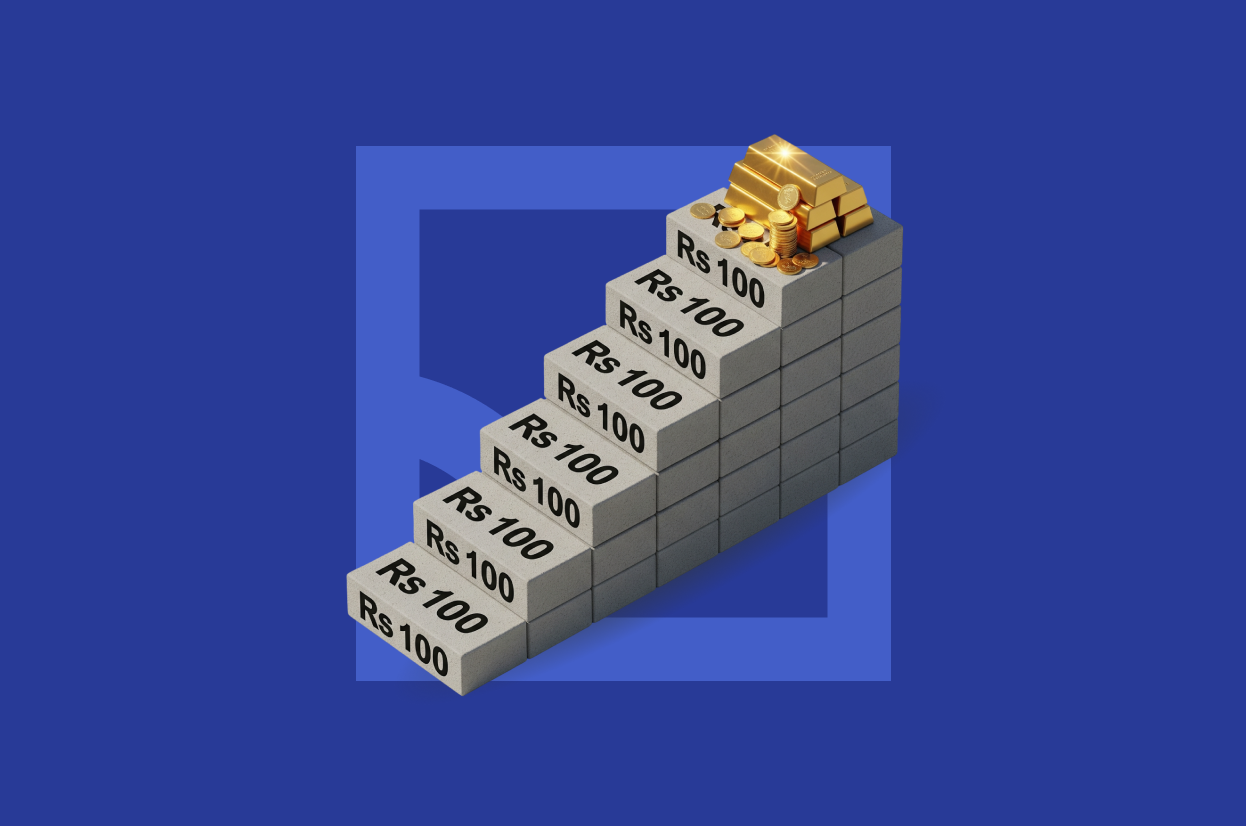

Gold has long been a trusted store of value in India. Today, digital gold SIPs (Systematic Investment Plans) make it possible to start with as little as ₹100 per month and still build a meaningful investment over time. Let’s look at the facts, numbers, and why this tiny habit can yield a big gold corpus.

What Is a ₹100 Gold SIP?

- Digital Gold SIP lets you invest small amounts (even ₹100/month) into 24K gold, stored securely in vaults and available for instant redemption in cash or physical gold.

- Popular platforms—like InCred Money, Aditya Birla, SafeGold, MMTC PAMP let you start from ₹100 with full transparency and insured storage.

Why Start With ₹100 Monthly?

- Affordability & Discipline

- Enables gold investing even for those with tight budgets.

- Small contributions add up steadily over months and years building habit and corpus together.

- Rupee-Cost Averaging

- By buying at regular intervals, you automatically buy more when prices dip and less when they’re high smoothing volatility over time.

- Liquidity & Convenience

- Easily traded online anytime, redeemable for cash or physical gold. No making charges, vault costs, or purity concerns.

Projected Growth: ₹100/Month Over Time

While precise figures depend on future gold price movement, the historical average annual growth of gold has been around 10–11% in India.

Assuming 11% annual price appreciation:

| Period | Total Invested | Estimated Value* | Gold Price CAGR |

| 1 year | ₹1,200 | ~₹1,260–₹1,270 | ~11% |

| 3 years | ₹3,600 | ~₹4,000–₹4,300 | ~11% |

| 5 years | ₹6,000 | ~₹7,500–₹9,000 | ~11% |

| 10 years | ₹12,000 | ~₹17,000–₹20,000 | ~11% |

*Estimates before fees or taxes. These are illustrative based on average growth rates—each investor’s return will vary.

Other Considerations

- Fees & GST: Platforms may levy storage or platform fees (typically under 0.5%). GST (3%) applies to purchases. These modest charges slightly reduce net returns.

- Taxation: Buying digital gold is subject to LTCG/STCG rules—if sold after three years, long-term capital gains are taxed at 20% with indexation; before three years, taxed as per slab rates.

- No interest payments: Unlike Sovereign Gold Bonds, digital gold doesn’t pay interest, but still lets you benefit from gold price appreciation at a lower initial cost and full liquidity.

Final Thoughts

Even a ₹100/month digital gold SIP, over the years, can grow into a notable gold holding thanks to the power of compounding gold price rises and consistent investing. While returns aren’t sky-high, the discipline, affordability, and diversification make it a smart micro‑investment strategy.

For InCred Money users, integrating a gold SIP into your monthly savings routine means turning small digital savings into a tangible asset building fitting perfectly into a habit-to‑wealth journey.

Ready to go for gold? Start your digital gold journey today on InCred Money.

Sources